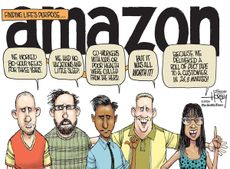

John Oliver wants you to know how much corporations are still not paying in taxes after Trump's tax cuts

"Tonight, in honor of upcoming tax day, we thought we'd give you just a glimpse of the lengths that companies will go to to legally avoid paying taxes, both," John Oliver said on Sunday's Last Week Tonight. Like Cardi B, "many people are perplexed and mystified by our tax system," he said, breaking down where your tax dollars go, roughly speaking.

When President Trump signed the GOP tax overhaul last year, he "made some clear promises about who stood to benefit," Oliver said, most of them "clearly nonsense, because if this bill were really helping the people that like Donald Trump best, it would exclusively benefit Eric Trump, Rosanne Barr, and anyone who's looked both ways before whispering, 'It was the Jews.' And the truth is, for all Trump's talk of pipefitters, the biggest tax rate cut by far actually goes to businesses."

Oliver walked through the "long and infuriatingly proud history" of corporate tax avoidance, with a special nod to Apple and Google for being top "innovators in weaselly accounting," though GE and other huge companies paid zero federal taxes for much of this century. The new tax bill does force some of those companies to pay taxes on money stashed overseas, but at bargain rates — a gamble that did not pay off in terms of job creation in 2004, and probably won't this time either, Oliver said. "We just had a huge chance to reform our tax code and we absolutely blew it. Because effective tax reform is not just about lowering rates, it's about closing loopholes."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"So, on Tuesday, as you scrape together your taxes and like Cardi B, wonder what Uncle Sam is doing with your motherf---ing money, rest assured that Donald Trump's tax reform continues to let companies engage in sophisticated tax avoidance schemes," Oliver said. And he had a parting gift for those companies. There is NSFW language throughout. Peter Weber

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published

-

Empty-nest boomers aren't selling their big homes

Empty-nest boomers aren't selling their big homesSpeed Read Most Americans 60 and older do not intend to move, according to a recent survey

By Peter Weber, The Week US Published

-

Brazil accuses Musk of 'disinformation campaign'

Brazil accuses Musk of 'disinformation campaign'Speed Read A Brazilian Supreme Court judge has opened an inquiry into Elon Musk and X

By Rafi Schwartz, The Week US Published

-

Disney board fends off Peltz infiltration bid

Disney board fends off Peltz infiltration bidSpeed Read Disney CEO Bob Iger has defeated activist investor Nelson Peltz in a contentious proxy battle

By Rafi Schwartz, The Week US Published

-

Disney and DeSantis reach detente

Disney and DeSantis reach detenteSpeed Read The Florida governor and Disney settle a yearslong litigation over control of the tourism district

By Peter Weber, The Week US Published

-

Visa and Mastercard agree to lower swipe fees

Visa and Mastercard agree to lower swipe feesSpeed Read The companies will cap the fees they charge businesses when customers use their credit cards

By Peter Weber, The Week US Published

-

Reddit IPO values social media site at $6.4 billion

Reddit IPO values social media site at $6.4 billionSpeed Read The company makes its public debut on the New York Stock Exchange

By Peter Weber, The Week US Published

-

Housing costs: the root of US economic malaise?

Housing costs: the root of US economic malaise?speed read Many voters are troubled by the housing affordability crisis

By Peter Weber, The Week US Published

-

Feds cap credit card late fees at $8

Feds cap credit card late fees at $8speed read The Consumer Financial Protection Bureau finalized a rule to save households an estimated $10 billion a year

By Peter Weber, The Week US Published